Breakthrough or hype: The truth about DeFi

- Created at:

- Updated at:

Talk about decentralized finance has been around for about two years now. Having blown up the crypto space in 2020, DeFi continues to attract the interest of investors and ordinary users. But is this trend as promising as they say about it? Let's try to figure it out together.

DeFi in facts and numbers

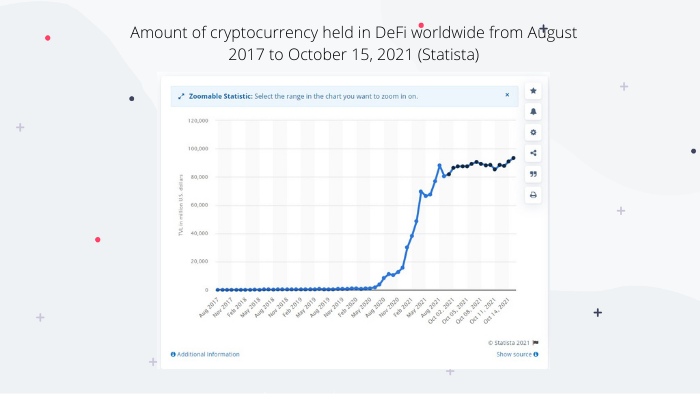

The best thing that represents the popularity of something is statistics, and DeFi has some really impressive numbers. According to Statista, the amount of cryptocurrency locked in decentralized finance stood at $93,396.67 million in October 2021, up from $30,017.99 in January.

Also, according to the DeFi Market Cap, the total market capitalization of DeFi was $92,837,471,576 at the time of writing. These huge numbers show that the interest in DeFi is real. Even with small periodic falls, the market keeps growing.

Today, the decentralized finance ecosystem is replete with a wide variety of DeFi projects. Most of them are still run on Ethereum blockchain, but taking into account the platform's issues with scalability and high gas fees, the situation may change soon.

For instance, blockchains like Solana and Cardano offer many benefits for dApps developers and some projects are migrating from Ethereum to such platforms. However, so far the number of active Ethereum wallets is growing and reached over 689,000 wallets in June 2021.

Pros and cons of decentralized finance

So why DeFi? What is it about decentralized finance that attracts thousands of users? First of all, DeFi has unleashed the full potential of the decentralized nature of blockchain technology.

DeFi offers the same financial crypto solutions but on better terms. From being able to act as a custodian of your funds and not trusting them to any platform, to anonymity and cheaper transactions.

DeFi is based on self-executing smart contracts that enable peer-to-peer transactions. What's more, most decentralized protocols are open source, so you can make sure the system works as promised and doesn't cheat you.

It is also important that DeFi systems are permissionless, which means they are available to users from any region, regardless of their credit history.

However, you shouldn't think that everything is so cloudless with DeFi. Criticism of the technology didn’t come out from nowhere. DeFi is associated with certain risks, including scamming due to the fact that anyone can create an address on the blockchain that looks like a legal protocol.

DeFi also has liquidity issues. For example, to take out a loan, you must block more value in the collateral than the value of your debt. To protect yourself from the potential danger when taking loans, you need to have sufficient collateral and understand the specifics of decentralized finance.

The good news is that the ecosystem is evolving and we will soon see an update called DeFi 2.0. The new concept aims to mitigate liquidity risks and address scalability issues. DeFi 2.0 rollout is expected in summer 2022.

Is DeFi overhyped?

Answering this question, you can say yes and no. On the one hand, DeFi does offer some revolutionary solutions for our time in crypto asset management and is driving the massive adoption of blockchain technology. The DeFi concept opens up more freedom for users to manage funds and more transparency in interacting with financial protocols.

On the other hand, decentralized finance is not a one-size-fits-all solution. DeFi has a fairly high threshold of entry and its impact is currently limited to the crypto world. Of course, this blockchain direction will continue to develop and occupy a certain share of the market, but if you want to benefit from this, you need to know exactly how you will do it and what is needed for this.

How to take advantage of DeFi?

We come to the most interesting part. So how do you take advantage of the DeFi boom? The main thing that attracts DeFi users is passive earnings. You've probably heard of yield farming. And you just have to deposit cryptocurrency into a selected DeFi platform or protocol in order to get a reward later. In order to do everything right and choose the most profitable protocols, we advise you to study this topic in more detail.

You can also use DeFi as an investment aid. Lending/borrowing protocols allow you to borrow a token or coin from a platform and put it into another platform for rewards. Also, the easiest way to invest in DeFi is through funds and trusts, such as the DeFi Index Fund.

Finally, if you already have experience with DeFi and know how to contribute to the ecosystem, invest in building your own DeFi protocol. While the market is evolving, you have every chance to create a successful product and take your place here.

Wrapping up

Decentralized finance has become one of the main technologies in recent years, discovering the true advantages of blockchain. This concept has made the idea of accessibility and transparency of financial services more real than ever, and that's why interest in DeFi still grows.

I hope you've learned more about DeFi after reading this article and now you can make a choice for yourself: is it hype or a breakthrough. DeFi is here to stay anyway, and if you are involved with the crypto market you better not ignore this trend. Hop onto the train and reap the rewards.

IdeaSoft is an expert software development company

Popular posts

-

Avoid These 6 Mistakes In Mobile Push Notification Designing

- 2

- 0

-

Which e-commerce platform is the most SEO friendly?

- 1

- 2

-

7 Best Features of Big Sur to Try Now

- 4

- 0

-

Most Common Causes for Customer Returns from Online Orders

- 4

- 0

-

Hidden JavaScript features of the Webix library

- 2

- 0

-

Machine Learning-powered Demand Forecasting: Transforming The Risk Into Opportunity

- 3

- 1